Maybe you need all the help.

Maybe you only need a little.

With BELAY’s customizable outsourced financial team, we have just the right solution for you and your growing organization.

Our Accounting Professionals are experts at delivering transparent, streamlined, and accurate GAAP-compliant financial information, managing accounts payable and receivable, and generating precise monthly and annual reports. This empowers you to steer your organization efficiently, enhance your ability to analyze operations, and make informed decisions for the growth of your organization.

Learn More About BELAY'sAccounting Services

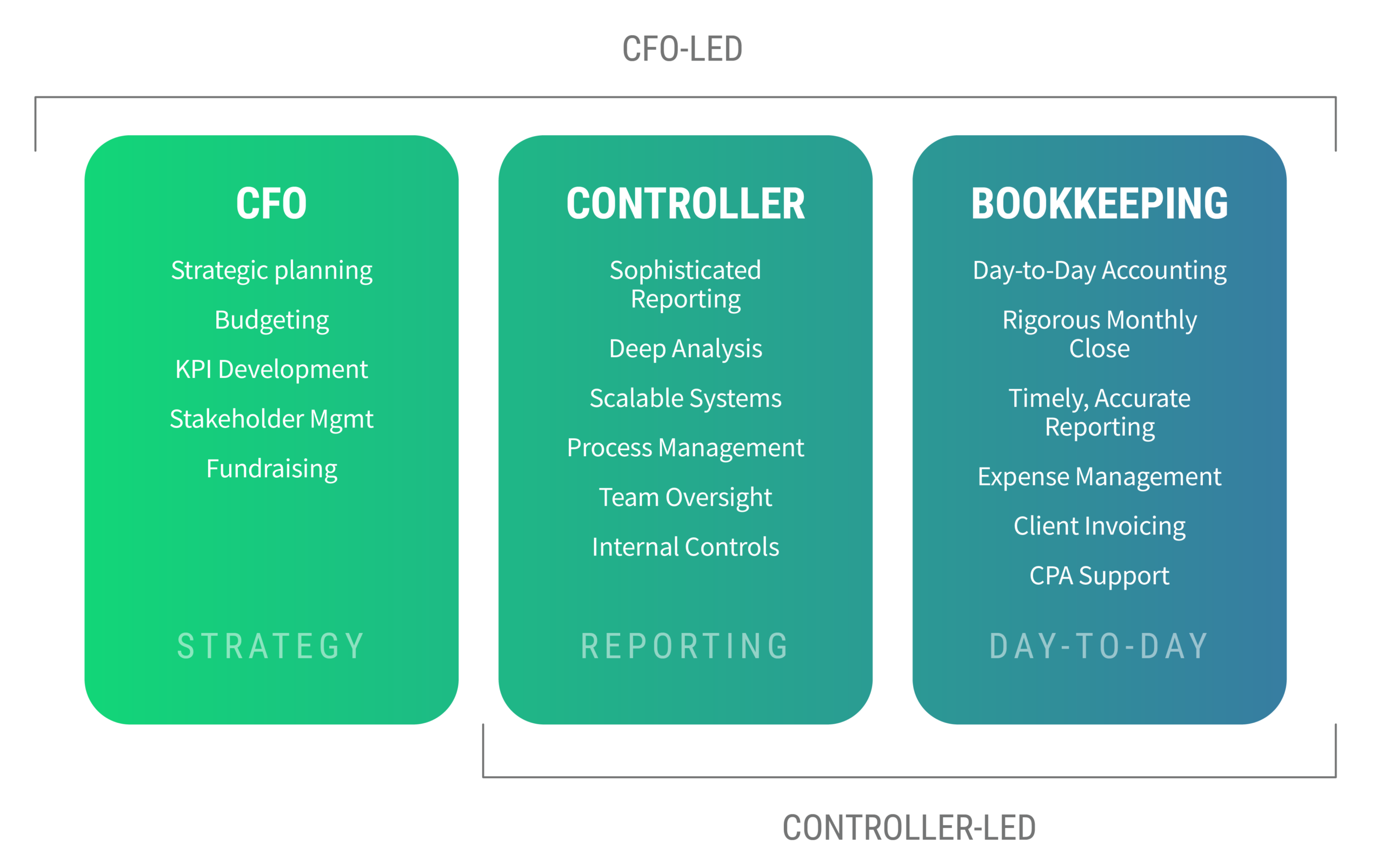

Our fractional Controllers serve as your integrated lead accountant, creating your financial strategy, implementing internal accounting procedures, and helping you navigate financial reporting, including preparing accurate and timely monthly financial reporting.

They also provide senior-level oversight for purchasing, invoicing, asset management, human capital management, and cash-flow analyses, the preparation of detailed budgets and forecasts, and the analyses of their performance and benchmarking.

Learn More About BELAY'sAccounting Services

Our fractional CFOs act as your integrated financial executive. By partnering with you, your partners, or executives, they develop and drive the overall financial strategy of your organization by developing strategic plans with a deep understanding of underlying economics.

They bring strategic knowledge and insight to provide a comprehensive service that includes conducting rigorous financial reviews, modeling, planning and analyses, orchestrating strategic profit planning and execution, and actively serving as a liaison with seasoned tax experts, lenders, and investors to optimize your organization’s financial landscape.

Learn More About BELAY'sCFO Services

Accounting Clerks, adept financial professionals, wield their data-entry expertise to seamlessly support accounts payable, accounts receivable, and other vital transactional processes integral to the bookkeeping cycle. Diligently organizing documents, they expertly apply incoming and outgoing payments with precision to ensure accurate account management.

Learn More About BELAY'sAccounting Services

Empower your business with a proactive BELAY Accounting Professional who skillfully manages every facet of payroll so you don’t have to.

From efficiently processing payroll and facilitating direct deposits to conducting precise payroll calculations and generating comprehensive year-end tax reports, our Accounting Professionals handle quarterly and year-end tax filing and payments with precision, going above and beyond for your financial peace of mind.

Learn More About BELAY'sFully Managed Payroll Services

As an add-on service for existing clients, your Accounting Professional will actively gather and meticulously prepare all requisite documents and forms, ensuring the seamless filing of your business taxes. This includes handling 1099 filings, sales tax, and quarterly filings to guarantee full compliance with IRS regulations.

Learn More About BELAY'sAccounting Services

Maybe you need all the help.

Maybe you only need a little.

With BELAY’s customizable outsourced financial team, we have just the right solution for you and your growing organization.

Our Accounting Professionals are experts at delivering transparent, streamlined, and accurate GAAP-compliant financial information, managing accounts payable and receivable, and generating precise monthly and annual reports. This empowers you to steer your organization efficiently, enhance your ability to analyze operations, and make informed decisions for the growth of your organization.

Learn More About BELAY'sAccounting Services

Our fractional Controllers serve as your integrated lead accountant, creating your financial strategy, implementing internal accounting procedures, and helping you navigate financial reporting, including preparing accurate and timely monthly financial reporting.

They also provide senior-level oversight for purchasing, invoicing, asset management, human capital management, and cash-flow analyses, the preparation of detailed budgets and forecasts, and the analyses of their performance and benchmarking.

Learn More About BELAY'sAccounting Services

Our fractional CFOs act as your integrated financial executive. By partnering with you, your partners, or executives, they develop and drive the overall financial strategy of your organization by developing strategic plans with a deep understanding of underlying economics.

They bring strategic knowledge and insight to provide a comprehensive service that includes conducting rigorous financial reviews, modeling, planning and analyses, orchestrating strategic profit planning and execution, and actively serving as a liaison with seasoned tax experts, lenders, and investors to optimize your organization’s financial landscape.

Learn More About BELAY'sCFO Services

Accounting Clerks, adept financial professionals, wield their data-entry expertise to seamlessly support accounts payable, accounts receivable, and other vital transactional processes integral to the bookkeeping cycle. Diligently organizing documents, they expertly apply incoming and outgoing payments with precision to ensure accurate account management.

Learn More About BELAY'sAccounting Services

Empower your business with a proactive BELAY Accounting Professional who skillfully manages every facet of payroll so you don’t have to.

From efficiently processing payroll and facilitating direct deposits to conducting precise payroll calculations and generating comprehensive year-end tax reports, our Accounting Professionals handle quarterly and year-end tax filing and payments with precision, going above and beyond for your financial peace of mind.

Learn More About BELAY'sFully Managed Payroll Services

As an add-on service for existing clients, your Accounting Professional will actively gather and meticulously prepare all requisite documents and forms, ensuring the seamless filing of your business taxes. This includes handling 1099 filings, sales tax, and quarterly filings to guarantee full compliance with IRS regulations.

Learn More About BELAY'sAccounting Services

Your BELAY Outsourced Finance Department

Our nonprofit and business accounting services

With BELAY, you get a team of real people – not a rotating team of faceless bots – but a team of seriously skilled, servant-hearted people to provide the exact nonprofit and business accounting services you need.

Business and Nonprofit Accounting Services from BELAY

Everything you need for the peace of mind you deserve.

At BELAY, our mission is to equip you with the confidence to climb higher and in order to do that, it’s important to note a few things that help us do just that.

- We serve clients exclusively on cloud-based accounting systems.

- Our services are a monthly subscription paid on the first of the month.

- We have a minimum monthly subscription of $455 per month.

Our fractional Accounting Services are expertly tailored to meet your exact financial needs so you can get back to doing what only you can do: growing your organization.

THESE BRANDS TRUST OUR FLEXIBLE STAFFING. YOU CAN, TOO.

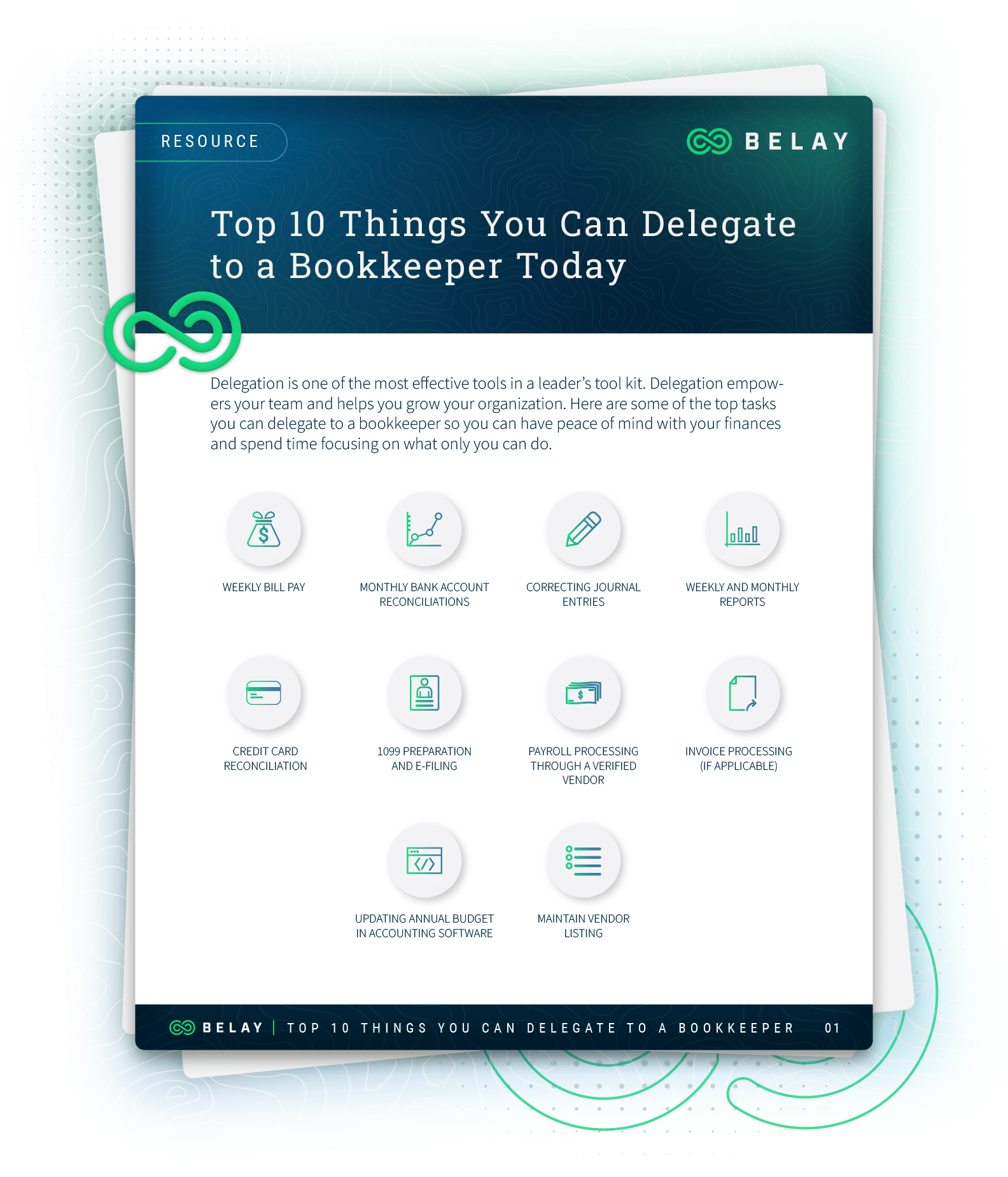

Top 10 Things You Can Delegate to a Bookkeeper Today

Here are some of the top tasks you can delegate to a bookkeeper so you can have financial peace of mind and spend time focusing on what only you can do.

DOWNLOAD

Got a question? No problem.

We've covered a lot so far. But you might still have unanswered questions about how BELAY's personalized matching process works. Allow us to ease any hesitations or concerns you may have before jumping into the process of hiring an Accounting Professional.

We are a full-service staffing solution providing bookkeeping, accounting clerks, full-service payroll, and fractional CFO services for businesses, churches, and nonprofits.

Of course! You’ll be assigned a Client Success Consultant who will walk through onboarding with you and who is there as a coach and resource for your entire time here at BELAY.

BELAY understands the importance of protecting you and your sensitive financial information.

In addition to our secure third-party payment system with BILL and our read-only access to bank accounts, we also have processes in place to properly vet each Accounting Professional, including conducting background checks and talking with their references to be sure we are placing a trustworthy contractor with your organization.

We have internal checks for compliance ensuring everything remains above board.

Additionally, all our contractors sign a Confidentiality Agreement to protect you and your organization. We highly recommend strong passwords and using a password manager to keep your accounts secure.

On average, our clients are matched within one week.

Your Client Success Consultant will meet with your Placement Team to discuss, vet, and select 2-3 top candidates from our bench of nearly 2,000 U.S.-based talent, and then interview and select the best match for you.

Yes, BELAY wants to be an engaged member of your team.

BELAY can customize a solution if you only need reporting and reconciliation.

Handing over the decision on who will work with you can be tough. But we know you donʼt have time to devote to screening and setting up interviews. We have a proven system to intentionally match you with someone equipped to handle everything you need accomplished.

You will have one dedicated Accounting Professional that we match you with based on your needs, industry, personality, and working style.

If, however, you work with a CFO and Bookkeeper or a CFO and an Accounting Clerk, you will work with more than one professional.

A Financial Specialist is more focused on tracking the day-to-day transactions that include paying bills, monitoring your cash flow, reconciling accounts, and preparing reports. An accountant can provide tax advice, certified audits, and a more high-level analysis of your organization's overall financial health.

Your Accounting Professional is focused on the transactional side of your needs. That responsibility is best supported by an admin team member. They can certainly provide the reports needed to show you what you spend with a particular vendor, but they will not help you shop vendors.

Just schedule a call with a BELAY Solutions Consultant today!